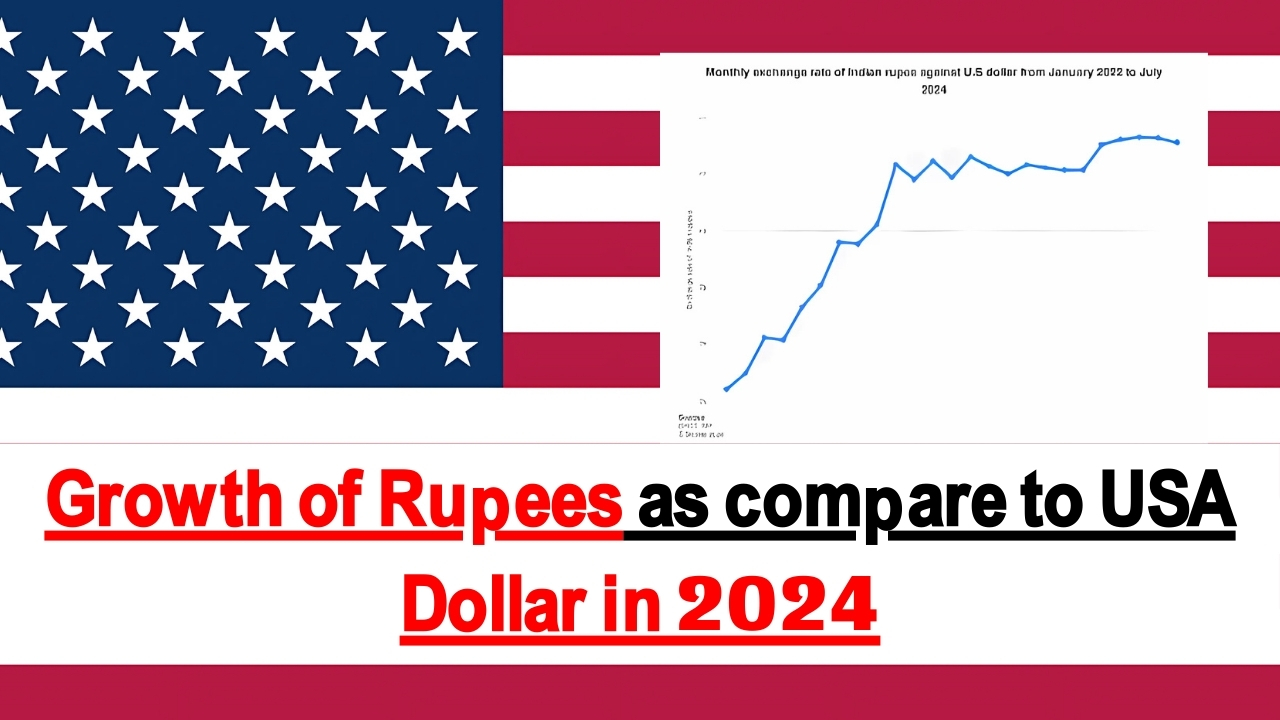

Growth of Rupees as compare to USA Dollar in 2024 : As the world economy navigates through a period of heightened uncertainty, one currency has emerged as a beacon of relative stability – the Indian Rupee.

After a tumultuous few years marked by pandemic-induced volatility and global macroeconomic headwinds, the Rupee is poised to make a strong comeback against its US counterpart in 2024.

Growth of Rupees as compare to USA Dollar in 2024 Factors Driving the Rupee’s Appreciation

Several key factors are expected to contribute to the Rupee’s growth against the US Dollar in the coming year:

1. Robust Foreign Capital Inflows

India’s economy has continued to attract significant foreign investment, with both foreign direct investment (FDI) and foreign portfolio investment (FPI) flows remaining resilient.

This influx of foreign capital has provided support to the Rupee, offsetting some of the downward pressures from global factors.

2. Reserve Bank of India’s Interventions

The Reserve Bank of India (RBI) has been proactive in its efforts to manage the Rupee’s volatility, utilizing its substantial foreign exchange reserves to intervene in the market and prevent sharp depreciations.

This strategic approach has helped stabilize the currency and instill confidence among investors.

3. Expectations of a More Dovish US Federal Reserve

As the US economy shows signs of slowing, there is a growing expectation that the Federal Reserve will adopt a more dovish monetary policy stance in 2024, with analysts forecasting multiple rate cuts during the year.

This shift in the Fed’s outlook is likely to weaken the US Dollar, providing a tailwind for the Rupee’s appreciation.

4. India’s Robust Economic Fundamentals

Despite global headwinds, India’s economy has demonstrated resilience, with strong domestic consumption, a burgeoning manufacturing sector, and a relatively stable fiscal position.

These positive economic fundamentals have bolstered investor confidence in the Rupee and its long-term growth potential.

Growth of Rupees as compare to USA Dollar in 2024 Analysts’ Forecasts for the USD/INR Exchange Rate

Reflecting these favorable factors, leading financial institutions and analysts have painted a positive outlook for the Rupee’s performance against the US Dollar in 2024:

-

Capital Economics : Forecasts the Rupee to climb to 78 against the US Dollar by the end of 2024, citing the expectation of a more aggressive Fed easing cycle.

-

Economic Times : Predicts the USD/INR exchange rate to trade at around 82 by the end of 2024, driven by continued foreign inflows and the RBI’s efforts to steady the currency.

-

Bank of Baroda : Expects the Rupee to fluctuate within a range of 82 to 84 against the US Dollar in the second half of 2024, gradually gravitating towards the lower end of the range.

-

Goldman Sachs : Forecasts the Rupee to appreciate to 81 against the US Dollar by the end of 2024, buoyed by expectations of substantial foreign capital inflows.

Growth of Rupees as compare to USA Dollar in 2024 Historical Context and the Rupee’s Journey

To fully appreciate the Rupee’s resurgence, it’s important to understand its historical trajectory against the US Dollar.

Since India’s independence in 1947, the Rupee has experienced a rollercoaster ride, with periods of both appreciation and depreciation.

In the early decades after independence, the Rupee maintained a relatively stable exchange rate, hovering around 4-8 Rupees per US Dollar.

However, the 1970s and 1980s saw the Rupee’s value erode significantly, reaching levels of over 17 Rupees per US Dollar by 1990.

The economic reforms and liberalization measures introduced in the 1990s marked a turning point, as the Rupee transitioned from a fixed exchange rate system to a more flexible one.

This allowed the currency to better adapt to changing market conditions, leading to a gradual appreciation against the US Dollar over the following decades.

Growth of Rupees as compare to USA Dollar in 2024 The Rupee’s Resilience in the Face of Challenges

Despite facing various challenges, the Rupee has demonstrated remarkable resilience.

The global financial crisis of 2008, the COVID-19 pandemic, and the recent geopolitical tensions have all tested the currency’s strength, but the Rupee has managed to weather these storms.

The RBI’s proactive interventions, the government’s policy reforms, and India’s robust economic fundamentals have all played a crucial role in maintaining the Rupee’s stability and positioning it for a stronger performance in 2024.

Growth of Rupees as compare to USA Dollar in 2024 Implications and Outlook

The Rupee’s anticipated appreciation against the US Dollar in 2024 holds significant implications for various stakeholders:

1. Indian Consumers : A stronger Rupee will make imported goods more affordable, potentially easing inflationary pressures and improving the purchasing power of Indian consumers.

2. Indian Exporters : The Rupee’s growth may pose challenges for Indian exporters, as their products become relatively more expensive in the global market. However, this could also incentivize exporters to focus on value-added products and improve their competitiveness.

3. Foreign Investors : The Rupee’s appreciation is likely to attract increased foreign investment, as investors seek to capitalize on the currency’s growth potential and the underlying strength of the Indian economy.

4. Policymakers : The RBI and the Indian government will need to carefully monitor the Rupee’s movements and implement appropriate policies to strike a balance between maintaining export competitiveness and controlling imported inflation.

As the world watches the unfolding of the global economic landscape, the Indian Rupee’s resurgence against the US Dollar in 2024 stands as a testament to the country’s economic resilience and its growing prominence on the world stage.

Growth of Rupees as compare to USA Dollar in 2024 Conclusion

The Indian Rupee’s journey in 2024 is poised to be one of remarkable growth and resilience.

Driven by a confluence of favorable factors, including robust foreign capital inflows, the RBI’s proactive interventions, and the expectation of a more dovish US Federal Reserve, the Rupee is set to appreciate significantly against the US Dollar.

This resurgence not only reflects the strength of India’s economic fundamentals but also underscores the country’s increasing global influence.

As the Rupee continues to gain ground, it will have far-reaching implications for Indian consumers, exporters, foreign investors, and policymakers alike.

The story of the Rupee’s ascent in 2024 is a testament to the dynamism and adaptability of the Indian economy, and it serves as a compelling reminder of the country’s potential to emerge as a dominant force in the global financial landscape.